Podcast: Play in new window | Download

Subscribe: RSS

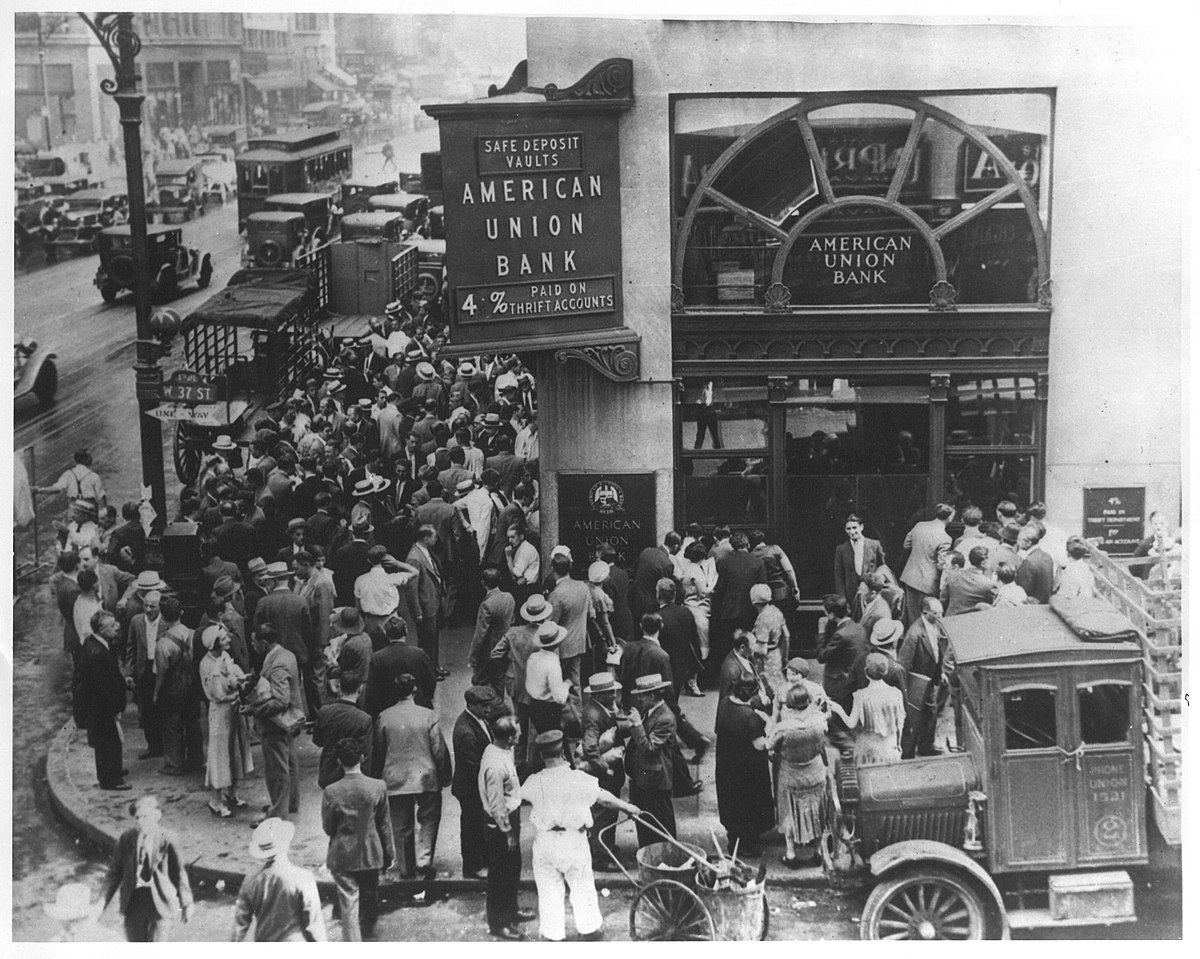

The good news is that with modern technology there’s no such thing as a run on the bank, because the bank doesn’t spend your money, it vaporizes it.

We were proud to be early adopters, back in the day. For example, I was the first editor at the enormous publishing company where I worked to own a personal computer — an Osborne with a four-inch screen and a storage capacity of a massive 64k worth of text, as I recall. I was among the first in my family to own a smartphone, and delighted in its capabilities. When it came to online banking, depositing checks with my phone, paying bills automatically and electronically, I was way out in the vanguard, and happily so.

I have always been a terrible typist, who with my manual typewriter often ruined an excruciatingly picked-out page with a misplaced digit on the last line, one who used gallons of whiteout. A day. Not only did the computer eliminate the agony of the misdirected fingertip, it invited me to play with alternate words and phrases, to see without penalty how different constructions would look on the page, and these were gifts beyond price for a struggling wordsmith. The phone, too, delivered value way beyond its price, acting as my navigator, internet browser, e mailer, entertainer and oh, yeah, it could make phone calls.

I have written elsewhere about how updates have nearly ruined my computer and smartphone. But more than that, the spread of technology oncology (more aptly christened by the folks over at Naked Capitalism “the crapification of everything”) is strongly suggesting to me that, as habitual early adopters, it is time for us to do a 180, as the pilots say.

I have in mind the banking aspect of the Crapification of Everything. Consider these recent events:

- Last Saturday, the National Australian Bank suffered a nationwide breakdown of its online banking system that denied customers access to their accounts and persisted for much of the day. Likewise for its subsidiary, the Bank of New Zealand.

- At the end of March, TSB Bank upgraded the online platform for its five million customers in the United Kingdom, about half of whom were active online. Hilarity ensued. Millions of people could not access their money or their credit. Direct deposits vanished, and people with active accounts were randomly declared to be deceased. Two months later, the chaos persists.

- In late February, North Carolina-based BB&T experienced two days of interruptions to its ATM, telephone and online services, which executives blamed on an “equipment malfunction.”

- In early February, TD Bank, an east-coast regional with 1200 branches from Maine to Florida, upgraded its online platform. Hilarity ensued for more than a week as hundreds of thousands of customers were denied access to their money. This occurred, said American Banker without any apparent attempt at irony, “despite careful planning.”

- In January, JPMorgan Chase website and mobile services went down for a day.

- In 2017, major internet banking systems crashed just about monthly, affecting Barclay’s, Frost Bank (Texas), Citizens’ Bank (Cleveland), JPMorgan Chase, PNC, Bank of America, HSBC, and Mississippi Valley Credit Union (which for some reason has not been rebranded as MVCU).

Just as we early adopters acted quickly on sensing a major new development promising benefits for humankind, should we not now react to proliferating evidence that our cash would be safer under our mattress than in an electronic account? When you add to the threat of technology oncology the additional perils of hacking, malware, the inadvertent revelation of passwords, fraud, and of course Wells Fargo, it becomes obvious what we must do.

Just as we early adopters embraced technology, leading the way to lives of luxury and ease, so we must now abandon it. Before it eats us alive.

And precisely how do we abandon technology? Better to ask the lion to abandon fang and claw, or the swallow to walk to Capistrano. The expansion its physical and mental abilities through artifice – technology – is basic to the human creature. It’s as natural for a human to build a skyscraper (or a computer for that matter) as it is for a beaver to build a dam…I’ll dispense with the ‘Tower of Babel’ analogy, apt though it may be.

At least this week we’re addressing the forest rather than the trees.

Most I know have a bank account, but do not use direct deposit. You just withdraw each paycheck to the minimum balance allowed, and use the cash. One quite literally deprives the bank of liquidity this way. Thus, they have two choices, either come up with a more honest business model, or close their doors. Of course, this may be one reason why various elites want to force a cashless society, as there isn’t truly a way to print funny money forever.

Just one way to reduce dependence on technology in this era. I’m sure there are many more.

I think the point is to also adopt simpler, less dependent technology — as a safeguard against catastrophic failure. It may not be possible to abandon the technology trap we are in… but it is possible to set up parallel systems that back-up the electronic, virtual world. Luddite Lite!

Here, here Mr. Lewis! It is time we examine, personally and collectively, each of the new technologies proposed to/imposed upon us and ask if they really are an improvement. We should also be asking how resilient and adaptable they are to a world we know will have less energy as each year passes.

I encourage you and your readers to read John Michael Greer’s “Retrotopia”, a narrative fiction in which he suggests that we regroup with time tested technology that uses less energy and is more reliable and resilient.

Keeping one’s money under the mattress brings risk of a different sort – namely somebody coming and stealing it physically. I would not want to put my life savings in cash in my home. Banks still seem less risky to me than that, at this point.

The rash of problems banks are having recently is very concerning, though. Keeping a little cash handy so you can buy groceries if somebody at banks or electricity grid messes up is a very good idea.

Referring to this post and the previous, it’s hard to believe anyone truly thoughtful and/or above the age of 50 would be taken in by the risible promises of the California philosophy (emanating from Silicon Valley and promising that for every modest difficulty there’s an app to smoothe one’s way in life). Youngsters have no memory of a world before the ‘Net, but oldsters do. This sense of betrayal inspires in me crocodile tears. In case it’s not perfectly clear, we’re all marks for the conmen and predators out there running gotcha capitalism.

It may not be necessary to retreat fully from every new bit of technology out there, especially since we’re effectively trapped by them if we want to participate in, oh I dunno, the economy, but it’s clearly necessary to adopt a highly skeptical embrace of whatever disruptive new thing demanding we forfeit our autonomy and privacy. The routine tradeoffs to which we’ve all passively agreed turned out to be sharkbites. You really didn’t know that?

You pretty much nailed it for me, Brutus.

“… gotcha capitalism,” ooooooh, I like it!! :) I’m glad to see your acerbic sense of humor is still intact. It was 20 years ago, almost to the day, that I first thought about writing a book titled “Frauds ‘R Us: How Americans Are Cheating Themselves, Each Other and Everyone Else.” Yet, as Mr. Knepp states, “you nailed it.” Alas, MOST, meaning at least 80-90%, of the “participants” in this grand facade are utterly oblivious to its ramifications and their role in perpetrating it. More depressingly, they ALL believe they are “thoughtful” and “intelligent” human beings while ALL the evidence skews otherwise. “Life,” by and large and however you or anyone else chooses to define that term, is ALL about the mother-f**kin’ money, ALL other priorities rescinded. Guy McPherson MIGHT be in error in his purported time-frame for human extinction but not by much. “Bracing for impact” is NOT going to alter the conclusion of this epic experiment in the absurd or alleviate ANY of the forthcoming suffering.

Mr. Lewis – I’ll try not to rant. Back when the only connection I had left to B of A was a lone credit card (having shifted everything else to a credit union) one month it was pretty close to the due date and I decided to swing by my branch and pay it, instead of the usual snail mail. I’ll just pull through the drive in … In the previous three years since I had been there, the drive in had been decommissioned. Well, I’ll just toss it in the night deposit. No night deposit.

So into the lobby I went. To face a long line and a teller and a half. The half being the teller who disappeared on an unknown errand. I looked around and it became very clear that the bank really didn’t want to deal with the “little people,” anymore. Lew