Podcast: Play in new window | Download

Subscribe: RSS

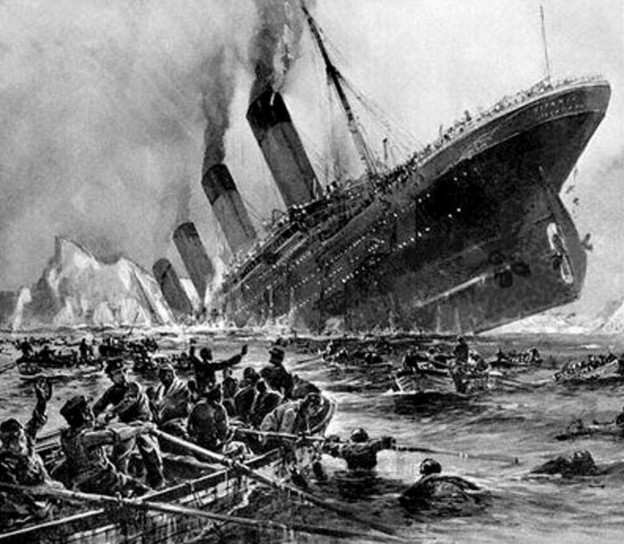

First you get some stowaway yelling avbout being “king of the world.” Then there’s this iceberg….

Just in the past week, the headlines have been coming like triphammer blows: in Bloomberg News, “Something has gone wrong with the global consumer,” (according to JP Morgan); in International Business Times, “G7 Finance Ministers to address faltering global growth;” in London’s Telegraph, “HSBC fears world recession with no lifeboats left;” in OilPrice.com, “Clock running out for struggling oil companies;” and even in the mainstream vanilla Washington Post, a column by Robert Samuelson predicts “China’s coming crash,” then puts a question mark at the end to make sure we don’t worry too much.

When you add these concerns to longer standing ones about wild gyrations in the world’s stock and bond markets; the advent of peak oil in pretty much every oil-exporting country in the world; the onset of the effects of global climate change in California, the Middle East, North Africa, Brazil and elsewhere; it becomes apparent that optimism ought to be listed as a disorder requiring medical intervention.

What’s wrong with the global consumer? In the imortal words of Howard Davidowitz, a leading expert on retail, consumers “don’t have any f’ing money.” It is slowly — way too late — dawning on the Masters of the Universe that unless ordinary people have money to spend — and by that we mean real money, not more credit cards or a third mortgage — the Masters are toast.

According to J.P. Morgan economist Joseph Lupton, “It would be difficult to overstate the recent downside surprise in global consumer spending.” Lower gas prices were supposed to stimulate spending. They didn’t. The high stock markets were supposed to encourage enough job creation to seriously dent unemployment rates and stimulate spending. They didn’t. The lackluster numbers of early spring were supposed to be the result of bad weather. They weren’t. “Clearly,” says Lupton, “something is off track.”

Indeed. International shipping is at historic lows. Energy consumption is declining. In the US, the trucking industry is starting to show weakness. At the same time rail-freight shipments are declining sharply. Retail stores are closing by the thousands. While, obliviously, the stock market soars to new heights.

Meanwhile, says International Business Times, “Finance ministers from the world’s largest developed economies meet in Germany this week against a backdrop of faltering global growth, scant inflationary pressures and a bond market in turmoil.” They’ll get to all this after they have figured out how to keep Greece from nuking the European Union by defaulting on its obligations because Greece hasn’t got any f’’ing money, either. Even if they can figure out how to amputate Greece without getting an infection, they will still be looking at either anemic growth or actual contraction in the powerhouse economies of the United States, China, Canada and Europe.

Now, even if you believe, as I do, that the notion of infinite growth on a finite planet is ridiculous, and the notion that all growth is always good is suicidal, you still live, as I do, in a system that will crash if its faith on growth is broken. So pay attention to these idiots. They’re driving.

Meanwhile, a report written by and for HSBC, the world’s third largest bank, likens the world economy to the Titanic, “sailing across the ocean without any lifeboats.” In fact the report is titled “The World Economy’s Titanic Problem,” and was written by a writer of financial horror stories appropriately named Stephen King. In his relentless account, the world’s central bankers have expended every bit of ammunition they have to stop the approaching iceberg of debt and depression, and the iceberg is bigger and closer than ever. You will stifle a scream as you read.

This gathering emergency is only invisible to those whose paychecks require that they do not see it. Unfortunately, that includes many journalists and virtually all politicians. The rest of us need to take another look at the pile of boards on the aft deck of the Titanic and get to work on our personal lifeboats. Now.

Thank you once again Mr. Lewis for laying it out for the tv audience who is too busy worrying about their latest distraction to even consider for a second that something is rotten in [insert your favorite country].

The spark you describe above will light up the world economy and burn all that paper into non-existence like so many fire-crackers, and is the beginning of “fast collapse.” Once the banks are no longer able to keep playing their games, the whole house of cards implodes, and with it go any and all government’s ability to control anything from security to keeping the lights on; beside that, all jobs that require a paycheck (including police, fire, emergency responders, the medical and pharmacy establishments, water coming through the municipal taps, gas at the filling station) end almost instantly – especially corporate ones.

So one day, probably before year’s end, we’ll be cruising along and suddenly it will all be completely different, thrown into confusion – i don’t know if even the news or the internet will still work.

If the grid goes down as a result, then we have only a certain amount of hours or days until the nuclear plants begin going Fuk on us all. Remember, nobody is going to report for work when there isn’t any food at the grocery, and the chaos in the streets takes over daily life. A LOT of people will die as a result of just the electricity failing – let alone the “mad max” violence that will be unleashed. Beyond that, ‘society’ will become ‘dystopia on steroids’ with a country such as ours awash in guns and no “law and order” (because the cops are all hanging around their own homes and families).

In the meantime, and while this is all going on for humanity, the world will continue to degrade ever faster as forest fires rage, tornadoes ravage the landscape (and there’s no more insurance), and we’ll all have to put up with the heat or cold (and all the other inconveniences), with whatever supplies we have . . . until they run out. Suicide will become very popular and might even give murder and mayhem a run for their money.

If the Greek exit doesn’t provide enough spark (maybe it will just be like smoldering leaves for a while), there’ always this:

Is The 505 Trillion Dollar Interest Rate Derivatives Bubble In Imminent Jeopardy?

http://theeconomiccollapseblog.com/

[which begins]

All over the planet, large banks are massively overexposed to derivatives contracts. Interest rate derivatives account for the biggest chunk of these derivatives contracts. According to the Bank for International Settlements, the notional value of all interest rate derivatives contracts outstanding around the globe is a staggering 505 trillion dollars.

[and ends]

It isn’t going to take much to topple the current financial order. It could be a Greek debt default in June or it may be something else. But when it does collapse, it is going to usher in the greatest economic crisis that any of us have ever seen.

So keep watching Europe.

Things are about to get extremely interesting, and if I am right, this is the start of something big.

I find it absolutely amusing that the word “interesting” has become a euphemism for both “terrifying” and “terminal.” With my best Arte Johnson impersonation, verrry interesting! ;) Where’s Rowan, Martin and Goldie when we “need” them?!?

Here in Singapore where I live the omnipresent facade of shallow and superficial cheerfulness continues to be the usual order of the day, as posters everywhere showing faces with twin rows of sparkling pearl herald the celebration of this nation’s fiftieth birthday and the staging of the SEA Games. The streets and immaculately polished shopping malls are saturated as ever with people and nauseating muzak. Being one who sees the coming iceberg one feels in this respect an almost surreal quality about the everyday life one leads here; you live such a life from day to day (I currently work as a private tutor), yet so much that you’ve learnt tells you it’s anything but normal, and cannot and will not last…

There are a number of telltale signs, to be sure. In the past two or three years it has apparently become customary for breakdowns and malfunctions to be anticipated in the islandwide railway transport system, at the stations of which escalators undergoing or awaiting maintenance are likewise becoming increasingly common. And in a newly opened (as in just a couple months) shopping mall near where I stay there are dozens of shop vacancies — most of them still vacant as of this writing. The number of operating shops in the mall can be counted using the fingers of one hand. I don’t remember having seen this sort of thing before here.

A few years back I actually had a word with one of our Members of Parliament here during a couple of the ‘Meet Your MP’ sessions sometimes held here, and talked to him about the crises precipitated by global resource depletion that await us all. If he got the message it didn’t seem to register on his face. I eventually gave him a copy of Richard Heinberg’s ‘The End of Growth’. Dunno if he’s ever read it, or if he did, whether he took it seriously and did anything about it. (Our then Prime Minister Lee Hsien Loong openly denied peak oil if I’m not wrong. Oops.)

Wonder if this island’s really going to wind up as an Asian version of Atlantis…

This is all fixable over night by kicking out the private owners of the Federal reserve in the U.S or the or privately owned Say bank of Canada etc. and have countries print their own money and stop paying interest on computer generated money out of thin air. Take the Banking system out of private hands and everyone will better off immediately. The greed element in the current system has to be done away with.

So right. so simple. so impossible. these powers are delusional and suicidal and we’re all going down with them. I have quit participating almost completely. If even a small percentage of first worlders would just quit buying un-necessary crap …

The article and comments provide insight into some of the deleterious issues occurring in the operation of industrialized civilization and how society will try to cope with the developing dire circumstances. I have collected a list of issues (based on the articles from a range of authoritative sources) to connect the dots to provide a holistic view of the situation. The list contains physical items such as the irreversible use of natural resources, the devastation of biodiversity, financial market manipulation, social consequences of over population and the damaging political decisions. The list is “What is irrevocably happening to our civilization” in my blogspot.

I am fostering the emergence of the Earth’s Lodgers’ Activity Management (ELAM) movement of the young to provide leadership on how to cope with the inevitable powering down. “Objectives of the Earth’s Lodgers’ Activity Management (ELAM) movement” s also on my blogspot.

You had all better star supporting then your organic farmers and sustainability experts ..If people do not begin providing for their own basic needs in small communal or tribal type sustainable groups there will indeed be nothing but death chaos and mayhem. Free yourselves by barter, trade.between communities. There is no such thing as a global tribe for a reason…it breaks down diversity.. You need diversity to continually renew. This is what sustainability is all about. when people realize if you spend your life in a corporate hole all your energy and time is sold and transferred out of your community. There is no true legacy in this no renewal. In order to keep communities strong and chaos free everyone needs to be busy putting back into their communities families and tribes..remember plan for your next 7 generations ..you can’t do this from some office.