”] The idiots savant who lead Wall Street stampedes off cliffs have a new sure thing: by which they mean a sure-fire, get-rich-quick scheme; and from which we should infer, take cover. First, the savant part; more and more of them are coming to believe that when you apply arithmetic and logic to the rate at which the industrial world is destroying natural resources, you are led to the conclusion that the edifice is going to crash. (Also see “Hedge Fund Guy Says Brace for Impact: Believe it Now?”) The idiot part is, they want to get rich from the crash, as they cling to the pathetic belief that, after the crash, having lots of money is going to be useful. So they are pumping up a new investment bubble — farmland.One hedge fund manager who did not want to be identified, perhaps because he sounds like an idiot, told the New York Observer that his fund is about “the 15th-largest farmer in America right now.” The guys in Guccis are actually operating the farms while waiting for the expected appreciation as world food prices skyrocket and supplies contract. He added, enviously, “A friend of mine is actually the largest owner of agricultural land in Uruguay.” Another hedge fund guy.

The idiots savant who lead Wall Street stampedes off cliffs have a new sure thing: by which they mean a sure-fire, get-rich-quick scheme; and from which we should infer, take cover. First, the savant part; more and more of them are coming to believe that when you apply arithmetic and logic to the rate at which the industrial world is destroying natural resources, you are led to the conclusion that the edifice is going to crash. (Also see “Hedge Fund Guy Says Brace for Impact: Believe it Now?”) The idiot part is, they want to get rich from the crash, as they cling to the pathetic belief that, after the crash, having lots of money is going to be useful. So they are pumping up a new investment bubble — farmland.One hedge fund manager who did not want to be identified, perhaps because he sounds like an idiot, told the New York Observer that his fund is about “the 15th-largest farmer in America right now.” The guys in Guccis are actually operating the farms while waiting for the expected appreciation as world food prices skyrocket and supplies contract. He added, enviously, “A friend of mine is actually the largest owner of agricultural land in Uruguay.” Another hedge fund guy.

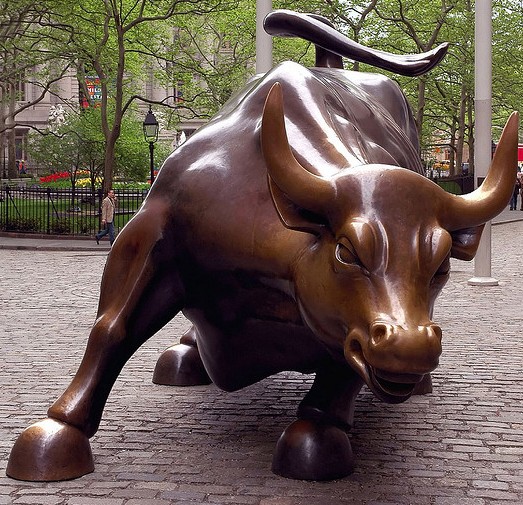

The same guys, or type of guys, who did the running of the bulls off the Enron/electricity cliff, the high-tech cliff and the housing cliff, who came up with collateralized debt obligations and credit default swaps, are now turning fire hoses spewing money onto arable land “with water on site,” as one genius puts it, apparently aware that we are also running out of water.

The effects are already setting peoples’ hair on fire here and there: Thomas Hoenig, the president of the Federal Reserve Bank of Kansas City, told Congress in February that sudden injections of capital have bid up farmland prices in Kansas and Nebraska by 20 per cent in a year, and are apparently going for doubled prices in four years. “Distortions in financial markets,” he warned (this is one guy who has called stridently for the too-big-to-fail perpetrators of the last financial meltdown to be broken up), “will catch the U.S. by surprise again.” One thing at which this country is still Number One: getting caught by surprise.

The newly stampeding investors see farmland as a hedge against hyperinflation (which may not be inflation in the classical sense at all, but the result of skyrocketing food and energy prices), a devalued dollar, and all the wheels coming off an indebted and defaulted government. As the Observer reported,

When asked if this is an end of the world scenario, the hedge-fund manager replied, “It really is. I tell my fiancée this from time to time, and I’ve stopped telling her this, because it’s not the most pleasant thought.”

Good thinking. If prospects are unpleasant, best not to mention them, to fiancées or investors. Would you like to know, sir, what the most unpleasant thought is? When we are just a little further into peak oil (far enough that you cannot get, or afford, fertilizer, or fuel for your farm machinery, or transport to get your crops to market), good luck unloading that thoroughly appreciated farmland. And if you do unload it just before the crash (we’re betting on you, after all you are a savant), congratulations! Your profits may be enough to buy a bunch of black-market carrots.

On the other hand, to the people who reacted to the imminent crash by investing time and work, instead of money, in that arable land with water on site, who moved there and learned to live sustainably on it, well to him and her, that land? Priceless.

This seems like capital just looking for a place to land. These “investors” know nothing about farming, its just a story that the hedge fund managers can tell their clients. It sounds plausible, perhaps just an extension of the “they aren’t making any more land” thesis. But its the wrong type of farming, all industrial, and its surely doomed to fail in light of inflating input costs. And larger scale won’t solve it. I’d truly like to see the economic analysis or the investment case. We need 5000 10 acre farms producing healthy food, not a single 50,000 farm producing unhealthy commoditized food.

Exactly. I read recently that China has for centuries fed its millions with farms that average four acres each. Now it’s replacing them with the industrial model, and will regret it. As to the capital “just looking for a place to land,” when it stampedes into a single market it is about as helpful as a tsunami.

***I read recently that China has for centuries fed its millions with farms that average four acres each. Now it’s replacing them with the industrial model, and will regret it.***

During the late 19th and early 20th centuries, the Chinese (well, many of them) became convinced they had to follow the ways of the West, or perish.

But now, the imminent exhaustion of the world’s key nonrenewable resources implies that China must UNfollow the ways of the West, or perish.

Fascinating how things can change with the tide of history.

I hope they all starve after we take the land back with weaponry.