Podcast: Play in new window | Download

Subscribe: RSS

Of course we’ll rebuild it, bigger and stronger than ever, but with what? (U.S. Navy photo of Hurricane Sandy aftermath by Chief Mass Communication Specialist Ryan J. Courtade/Released)

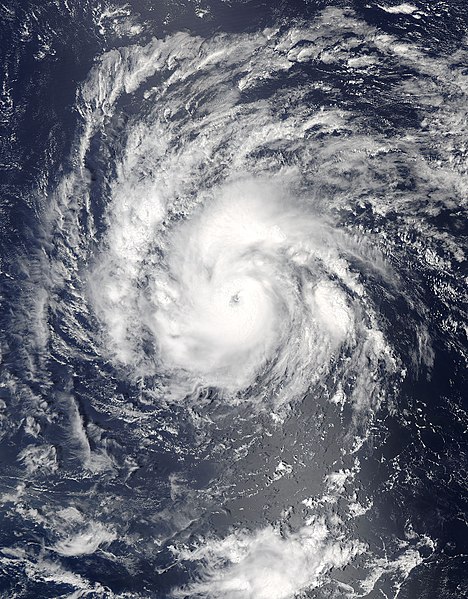

I have been trying to apply arithmetic to the problem of hurricane relief. I know, this is like translating computer code to cuneiform tablets, but bear with me — ancient learning was, after all, learning. The costs of recovering from Hurricanes Harvey (Texas), Irma (Florida) and Maria (Puerto Rico) are now estimated at about $220 billion. Congress has thus far appropriated $15 billion for the purpose, acting on September 9, the very day FEMA was expected to run out of money.

By its timely action, Congress solved seven per cent of the problem. With a burn rate of two million dollars a day, FEMA will be broke again in 75 days (from September 9). Nobody’s talking about this. At least, not in any way that makes sense. In a cheery piece claiming that FEMA can never run out of money, the explainer website HowStuffWorks says it can’t happen in the future because in the past, Congress has always bailed it out in time, just like it did with its seven-per-cent solution of September 9. Continue reading

(* that is, the 99 per cent.)

(* that is, the 99 per cent.) The later it gets in the year, the more pointed become the questions: “So. Where’s your Crash of 2015, eh?” (Some of the questioners are Canadian.) Reminds me of a story. I was in a strange city, to meet a person very important to my future, and had been given directions to, let’s call it the Metropolis Building. “Huge building, right on Main Street, you can’t miss it.” I followed the directions, but could not find the building. Increasingly frantic as the appointed time drew near, I gave myself a time out, letting a granite wall alongside the sidewalk support me as I gathered my wits. I decided desperate measures were called for. “Excuse me, sir,” I asked a passerby, “Can you direct me to the Metropolis Building?” The reply was accompanied by a withering look. “You’re leaning on it.”

The later it gets in the year, the more pointed become the questions: “So. Where’s your Crash of 2015, eh?” (Some of the questioners are Canadian.) Reminds me of a story. I was in a strange city, to meet a person very important to my future, and had been given directions to, let’s call it the Metropolis Building. “Huge building, right on Main Street, you can’t miss it.” I followed the directions, but could not find the building. Increasingly frantic as the appointed time drew near, I gave myself a time out, letting a granite wall alongside the sidewalk support me as I gathered my wits. I decided desperate measures were called for. “Excuse me, sir,” I asked a passerby, “Can you direct me to the Metropolis Building?” The reply was accompanied by a withering look. “You’re leaning on it.”