Podcast: Play in new window | Download

Subscribe: RSS

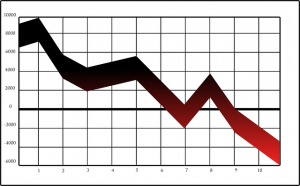

This is where every component of the world economy is going. To see the panic index, look at your screen in a mirror.

If the world economy were an airline, what we’d be seeing now is hundreds of late and cancelled flights, missing airplanes, bankruptcies, thousands of staff layoffs and millions of unhappy customers. (Whoa, that was supposed to be a metaphor!) If we were in a hub airport of this airline, every incoming flight would be a tattered, smoking airplane with flat tires and bullet holes bearing more bad news from shell-shocked passengers. Some examples:

International Arrivals:

From China: The Shanghai Composite Index lost 13.4 percent of its value in July. That’s more than a correction and would have been a crash if the government had not a) halted trading in half the stocks listed, b) forbade the selling of large blocks of shares, and c) bought most of the shares that were sold. To say that these measures are not working (except that they have temporarily frozen the crash at gunpoint) is an understatement. The Chinese Crash of 2015 is well under way. [See: Peak Insanity: Chinese Brokers Now Selling Margin Loan-Backed Securities, and “China’s Hard Landing Suddenly Gets a Lot Rougher,” among many others.

From Greece: With the Grexit crisis declared over, the Greek stock market opened last Monday, and promptly crashed; all stocks down 23 %, bank stocks 30%. By Friday it had clawed back about 20 points but was some 600 points down on the year.

From Puerto Rico: On Monday, Puerto Rico became the first U.S. Commonwealth Territory ever to default on a debt payment.

From Venezuela: food riots are breaking out in the aftermath of the economic devastation wrought by the crash of oil prices.

From Canada: Implosion of the tar-sands-oil patch and a related bursting of the housing bubble has the country in an all-but-declared recession.

From Everywhere: Commodities are tanking and taking the currencies of the commodoties-exporting nations with them. As happened just before the crash of 2008, the price of virtually every industrial commodity –not just oil, but copper, coal, steel, lumber, you name it — has crashed because of drastically slowing manufacturing worldwide, especially in China.

Domestic Arrivals:

From North Dakota and Texas: America’s zombie shale-oil frackers are finally running out of gas, so to speak, after being propped up despite the crash of oil prices by 1) an avalanche of investment and credit from money handlers convinced the dip was only temporary, and 2) hedge contracts that meant they were still getting some $90 a barrel when the market was around $50. The avalanche is now going the other way and the hedge contracts are running out. Investopedia lists seven major players on the verge of bankruptcy. According to Bloomberg Business News, North American oil producers have seen a stunning $1.3 trillion of their equity valuation vanish in one year as a result of the crash in oil prices. The sudden loss in value has hit a multitude of pension funds and insurance companies hard.

From New York: The stock market is on its knees. The Dow Jones Industrial average at the end of the week down 700 points since July 16, and 900 points off the market peak in May. In addition to oil and energy issues, tech stocks (Apple, Twitter, Yelp, etc.), mainstays of the recent market, are down sharply. As are the up-to-now-reliable cash cows, the media stocks — Disney, CBS, Time Warner etc.

From Washington: In each jobs report the government insists that the unemployment rate is stable and job creation is improving. Look a little further and you see that each month, the number of people leaving the labor force is far larger than the number of jobs created; and that the number of jobs vanishing each month is rising fast; the number of jobs cut in the US in July, 106,000, was the highest monthly total since 2011 and up 136% from the previous month, 125% year-to-year.

From all over: Factories’ output and consumer spending are weakening as oil production drops (as even the Energy Information Administration is now admitting).

This is far from an encyclopedic review of the bad news that arrived at our gates last week. I have been assembling it for a week, and found that by the time a draft got to be a few hours old, much of the bad news had been replaced by worse news. And then of course I was waiting to hear how the Republican candidates for President would deal with these urgent and mounting threats. Still waiting. You heard anything?

Gotta go. New arrival at Gate 78.

That’s great Mr. Lewis! Indeed, the implosion of civilization due to our fossil fuel binge, rampant pollution and ruined environment can’t hold out “pretend and extend” against reality forever. This is the beginning of the steepening curve down.

By next month and this last quarter, it will become increasingly apparent to those who up til now have been blithely unconcerned, that matters are only going to get worse as time goes on. [Maybe a few years off, but once the food shortages take hold, the chaos and destruction will commence – as they are happening now in other affected countries].

Gerald Celente Is Predicting That A Stock Market Crash Will Happen By The End Of 2015

http://theeconomiccollapseblog.com/

Looking forward to the many reader comments this will generate. Super job!

Industrialized civilization, led by the Western economies with the Eastern ones now following, have irreversibly used up much of the limited natural resources, including oil, produced vast amounts of irrevocable waste material, including those that have precipitated climate change and ocean acidification, provided a vast irrevocably aging infrastructure while devastating the eco systems. That is the stark tangible reality that is starting to hit hard in a number of ways, including those discussed in the article. the ineffectiveness of intangible money will hit home very hard.

Yes, in ancient Rome, when their currency crashed, at least it was made out of actual silver and gold and might have been worth something after the Western empire fell. But our money derives all its worth from future industrial production that simply isn’t going to happen beyond a certain point. Then what money actually exists as cash (and that’s a small percentage of it) will just be elaborately printed pieces of paper.

Read yesterday that if unemployment were calculated as it was before Clinton, the unemployment rate would be 23%. Its now called U6 and only U3 is reported. The current calc ignores short and long term labor force loss, those that have just given up looking for work.