Podcast: Play in new window | Download

Subscribe: RSS

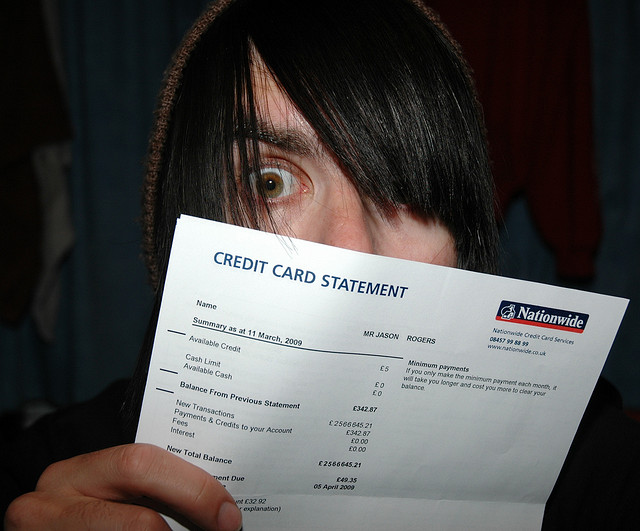

Don’t worry about the bill, we’ll think of something. In the meantime, please, keep spending. Your country needs you to. (Photo by Jason Rogers/Flickr)

I don’t know why we worry so much, when American ingenuity has always risen to the occasion, every single time, to snatch victory from the jaws of success. Once again, American financial engineers have analyzed the problem — the central problem of the American economy — and after having a couple of beers have come up with the solution. Brilliant. Prosperity is at hand.

These particular engineers are employed by Fair Isaac, who is not a handsome English squire, but the oddly named company that assigns the credit scores upon which 90% of all personal lending decisions — from credit cards to car loans to rental contracts — are based. They have come to understand that the core problem of the American economy in the 21st Century, as pungently stated by retail-sales guru Howard Davidowitz, is that consumers don’t have “any fucking money.”

Astute readers of retail history will remember that this problem first surfaced in 1959, prompting the invention of the credit card. That fix lasted until 1999, which was the year every credit card in existence reached its limit. Only briefly perplexed, the financial engineers immediately introduced the house-as-ATM business model, and taught Americans how to refinance their homes every 90 days to pay off maxed-out credit cards and get cash for necessities, such as personal watercraft and all-terrain vehicles. Which worked until 2009, when the market answered the question: “What could go wrong?”

Now consumers are stuck in houses that are under water, slowly paying down credit-card and school-loan debt, and cannot do their patriotic duty for the larger economy by shopping, because they don’t have, in Mr. Davidowitz’s deathless phrase, AFM.

So what to do? We can’t pay workers more money, because that would harm the luxury personal jet and high-end vacation villa industries, and besides it would send the wrong message. We’ve had a pretty good run lending them money for cars. By offering anyone with a credit score higher than his shoe size a no-money down, 100%, six-year loan to buy a Hummer, we have made the auto industry a standout achiever in our otherwise lackluster economy. But we’re running out of people with small shoes.

Who cares about low credit scores? Hardly anybody, because the people who make the loans don’t care if they are ever repaid because they own the paper for about 15 minutes before they cash out and let someone else worry about it. However, in order for them to take bunches of subprime loans and sell them as AAA investments, some rating agency has to stamp them AAA. And as willing as the rating agencies are to destroy modern civilization for a fee — they came really close in 2009 — they don’t want to be visited by mobs of investors bearing pitchforks and torches, so the agencies get hinky when they see credit scores in their loan packages that are in negative territory.

That’s the problem brilliant engineers at Fair Isaac have solved. They are rolling out a new FICO credit score for underachievers, one that will give you a satisfyingly high number if you have managed to keep the lights turned on in your house, and that ignores sticky-wicket issues such as repossessed stuff and delinquency nonsense.

(I am not making this up. Although I did delay writing about it for two weeks in the expectation that it would be revealed as an April Fools joke.)

So there you have it. Let the consuming resume, and never think for a moment that American ingenuity will ever stop catering to our greed, bolstering our self-esteem and helping us blow up the world.

Ha-haaa, yes Mr. Lewis – thanks for pointing that out!

It was once suggested by someone that everyone should always spend more than they have to keep the money going around – that nobody is going to come to collect it too. Now that the people at the top want it all back and then some, things have [obviously] frozen up in the spending department. If they can get it all – and they’re trying – the rest of us are going to go hungry in the streets. Trouble is, everyone knows where the rich live.

Well, i don’t think they thought of that until just recently when this new policy was created that will allow the spigots to keep delivering water and for the electric to stay on for a while longer yet. There are even larger problems looming and they’re all going to converge into one monumental shit-fest, and sooner than anyone thinks.

https://www.youtube.com/watch?v=WbrjRKB586s

“That fix lasted until 1999, which was the year every credit card in existence reached its limit.”

Really? Is this true? I’d sure like to see a link verifying this… It wouldn’t surprise me in the slightest… Our credit cards were sure maxed out at the time…

Well, that was just so incredibly well said that it made me jealous that I hadn’t said it. I’m a new subscriber and will include your site on my blog roll. Bravo!

What puzzles me the most about any of this is… Why is the FICO system still in use? I mean, every damn day there are countless commercials telling “us,” the consumers, that we have to check/monitor our credit scores at least quarterly, if not monthly or even weekly to ensure they are “accurate.” There are stories reported nearly daily at how “error-prone” Equifax, Experian and TransUnion are, lending credence to the aforementioned advertising. Yet, if this system is so fallible, why would ANYONE, especially the creditors, think it a valid reference? Moreover, why is it so damn difficult, not to mention expensive and time consuming, to affect corrections at any of these reporting agencies? Of course, those are rhetorical questions as the answer to all of them is obvious. It is all nothing more than a scam to part fools from their money and otherwise distract and preoccupy the masses so they can never understand just how severely and why they are being robbed at every turn. Ignorance and incompetence rule the day and there IS only one way this ends… and no one is going to find it “pleasant.”

Very well done. Unfortunately, the people who need to hear, see and understand it are not listening or watching. But there’s only so much that we can blame the whores in marketing, finance and the media for (not that they don’t carry blame). A little common sense and a little less keeping up with the Joneses from the “victims” would have gone a long way toward avoiding several market/economy implosions. You can blame the dealer, but the junkie keeps him in business.

Indeed, it does take two to tango. However, what is it when one “partner” has been given little, if any, “perspective” save for the incessant programming geared solely to create good little subservient “tools” since the day they were born? Yet, all too soon it won’t matter at all.

“Credit” is the biggest scam there is. Nobody needs credit. Nobody should get credit. Nobody should be buying what they can’t actually pay cash for. Everyone by now should know all of this. Credit is a huge scam, fleecing trillions of dollars from the desperate and the greedy, enriching these horrible corporations even more. Fuck credit. Forever.

My sentiment exactly.

“…financial engineers immediately introduced the house-as-ATM business model.”

And here I thought it was Congress’ idea when they eliminated the personal loan interest tax deduction, but kept the mortgage and home equity deduction. As I recall, everyone paid off their credit card with a home loan.

The finance industry and congress are practically one and the same. The policies are set at the behest of finance in order to herd the masses into the next scheme .