Podcast: Play in new window | Download

Subscribe: RSS

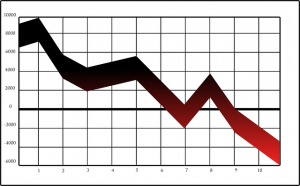

This is where stock and gas prices are going. To see the panic index, read from right to left.

Gasoline is below three dollars a gallon and the stock market is at an all-time high. Well, yes, that was last week but still. What could be wrong with this picture? Like a face that has had way too many plastic surgeries, this one is stretched a little thin, with eyes bugged out and droplets of sweat all over it. The market, which all concerned promised would go up and up and never come down (Does anybody remember them saying the same thing about real estate? Anybody?) has lost 7% of its value in a week and, yesterday at least, could not pull out of the nose dive. A 10 percent drop is a correction. Twenty percent is a crash. And the low gas prices are being celebrated by everyone but the frackers who brought them to us. For them, low oil prices mean almost-immediate ruin.

The stock market stampede has not yet begun in earnest, but the lightning strikes are getting closer, the thunder louder, and the bulls are getting ready to run. The latest signs and portents:

- The Volatility Index (the extent to which the bulls are running around in panicked circles) has gone up 80% so far this year — 60% just in the past week.

- CNN’s aptly named Fear and Greed Index, which goes from 0 (total panic) to 100 (unrestrained exuberance) is at 1.

- Bloomberg reports that the world’s 400 richest people lost $70 billion from their cumulative net worth last week. OK, hold the tears of sympathy if you must, but as Everett Dirksen used to say, a billion lost here, a billion vaporized there, pretty soon you’re talking real money.

- The Price/Earnings Ratio — the price of the stock compared with the profits of the company — is at 26x, its highest value in 135 years with the exception of just before the crashes of 1929 and 2000.

Meanwhile, there’s panic in the fracking patch, because nobody was making any money when oil was selling at $100 a barrel, and now it’s at $80 and diving.

To be clear: the frackers have been showing profits on their P&L statements — lots of them — but it’s the balance sheet you have to look at to understand that they are borrowing so much money to build so so many more wells that they are drowning in debt. The number of fracking wells has quadrupled in five years, to more than 1300. The frackers aren’t doing this because they want to — they have to, because the wells play out in four to five years. As Bloomberg Businessweek puts it, “US Oil Producers May Drill Themselves into Oblivion.”

The 60 fracking companies (almost all of them) that Bloomberg tracks, in the year ending June 30, spent an average of $1.17 for every dollar they earned. It’s the oldest joke in retail; if you lose money on each unit you sell, you make it up with volume. The frackers no longer think it’s funny; they have racked up $50 billion in debt in just three years, and are now carrying $190 billion, most of it raised with junk bonds.

Keep in mind that these less than stellar results were achieved in a period when oil was selling at $100 and more. Now that it seems headed south from $80, even the nominal, paper profits are going away and all these operators, who were teetering at the edge of solvency in the good times, are going to be toppling into the swamp very quickly.

But wait there’s more. Because of the ugly decline rates of these wells — they play out in about four years — the operators are going to have to drill more wells in the next three years than they did in the last three, just to stay even. That means they will need to borrow much more money. (Um, is there a classification below “junk?”)

When fracking hears that the stock market’s crashing, and the market hears that fracking is crashing, there will be nothing left for them to do but get in their Mustang convertible, join hands, and enjoy a Thelma and Louise moment.

We are entering a real Catch-22. High oil prices permit fracking which reduces imports, but puts a crimp in economic growth. Low oil prices crush fracking, causing oil imports to rise, and again it restrains economic growth.

Good point James – it’s a lose-lose situation any way you slice it!

Mr. Lewis, I always enjoy your perspective on things and this one didn’t disappoint, especially the way you portray the end. Looks like we might be in for the first leg of the total collapse of industrial civilization next year with the economics crumpling into the fantasy that they always were. After that comes the widespread mayhem, rampant disease spread (already happening), probably even more war and internal chaos in each state and nation.

As De Niro might say it, “eh . .. it dudent look too good.”

Oil & gas companies are simply not that dumb. They’ll shutter projects and just hold onto reserves until prices recover, just like any other commodity. As far as stocks, they are the one thing that people simply refuse to buy when they are “on sale” for 10-30% off. They’ll bargain shop everywhere else for everything else, but just not for stocks. When the VIX is high its time to buy. Well managed, high quality, low debt, cash gushing, dividend paying companies, yes please. Thank you very much Mr Market for the sale. Can we mark them down another 15-20% more please. The crowd can go chase the high debt profitless cash burning IPO gems like a bunch of horse flies.

But wait, there’s more …

Fracking companies can’t get a loan because the price of oil is too low and they are leveraged to the max already, so they stop drilling.

The economy falters because the banks that loaned the money to the frackers can’t get their money back.

Because the economy is down, the price of oil stays below $100/bbl – maybe lower.

The fracking companies can’t get a loan so they can’t start drilling.

The economy falters because there is no oil, and with no oil to mine with, no coal.

and so it goes until we are all doing subsistence farming or starving. That is the definition of collapse and we MAY be watching it happen right now.

Got farmland?

I can’t imagine how anyone with a brain ever thought fracking would be profitable. It’s beyond me.