Podcast: Play in new window | Download

Subscribe: RSS

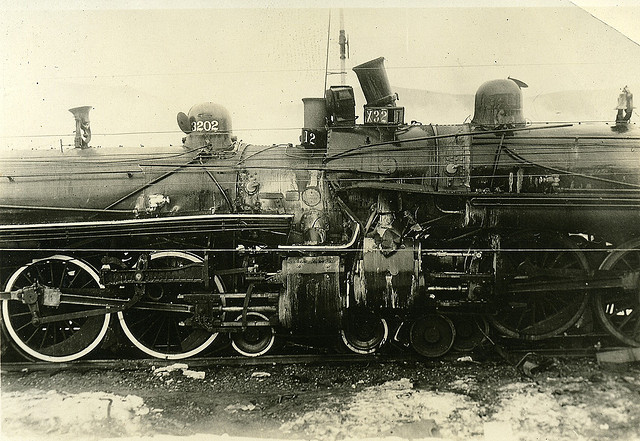

Coming soon to an economy near you: a two-train wreck.

The second train wreck about to sledgehammer the world’s economies is the implosion of the oil-and-gas renaissance scam. This implosion, most likely to occur in 2015, may occur before Train Wreck Number One (the financial “correction,” see the previous post, Financial Storm Flags Up: Take Cover) and bring it on, or it could kick in just afterward as the panicked Masters of the Universe run for the lifeboats. The cumulative effect of the two events will be devastating and lasting. They are not likely to bring on, quite yet, the ultimate crash of the industrial age — there is a lot of momentum left in the old battleship yet. But they will come close. Because while the financial implosion may not be quite as bad as that of 2008, the end of the oil scam, in itself, will be devastating to the world.

Big Fracking Lie. For at least five years now, the hype has been relentless.

Technology, in the form of hydraulic fracking, has saved us. With it, we have unlocked huge new reserves of oil and gas that will last a hundred years. We will surpass Russia and Saudi Arabia, become Number One in the world again, even reach energy independence! It’s gonna be great!

Now, the hype wasn’t aimed at you and me, it was directed at the people who move money around, because it takes a lot of money to frack a well. And in that respect the hype has worked — panting investors have opened their checkbooks and emptied their minds to finance this new American oil boom — even though, as I have been writing here for five years [See A Frack Job for Marcellus, December 2009, and many others], the hype flies in the face of arithmetic and logic.

There is no question that during the past decade, hydraulic fracturing in horizontally-drilled wells has greatly increased U.S. extraction of oil and gas. Gas frackers pretty much blew themselves up by bringing so much gas to market that they lowered prices below the cost of production; in the past two years natural gas extraction has been virtually flat.

Oil is a different animal. It goes into a global system, and is priced globally. The 3.7 million barrels a day of additional oil from the four main shale-oil plays in the U.S. went into a system that gobbles 80 million barrels a day, in a country that uses 20 million barrels a day, so the impact on global prices has been minimal. At best, shale oil can be credited with preventing steep price increases over the past five years or so based on flat and falling oil production in the rest of the world.

It is remarkable that it still seems irrational to talk about the end of the shale oil and gas boom and the return of peak oil worries, because the evidence all along has been abundant and clear that the boomers are the ones who have been irrational. And mounting evidence now indicates a breakdown is near:

- Nothing lasts forever; fracking doesn’t even last a year. Traditional oil wells increased in productivity over years, then declined gradually over years, often having a useful life of 20 years or so. Fracked wells max out in a few months, then decline an average of 60 per cent in the first year. So if you’re a fracking company, and you want to show your investors rising production in your second year (and you do), you had better bring a new well on line at the beginning of that year. And two more the next year, and four the year after that. You’re on a fracking treadmill.

- When the treadmill goes around fast enough, it throws you off. This treadmill effect is the reason why none of the players in the fracking revolution are making any money. According to a report out of Energy Aspects last year:

“As a result, the average Capex (capital expenditure) spending of the 35 companies analyzed to serve as a guide to the industry has amounted to a staggering $50 per barrel of oil equivalent (BOE) over the last five years, at a time when their revenue per BOE has averaged $51.5.”

- The only way to stay on the treadmill is to borrow money. Lots of money. Led by the frackers, the oil business as a whole is going seriously into debt with little to show for it. According to the US Energy Information Administration, 127 oil and gas companies worldwide took on $106 billion in additional debt in the first quarter of this year, while at the same time selling off $73 billion in assets. Collectively, their cash flow for the past year was negative $110 billion. In the shale patch alone, according to Bloomberg, in four years debt has doubled while revenues have risen 5.6%.

- The sweet spots are going sour. The hypists have talked continuously about shale oil reserves as if all oil-soaked shale rock was equal, and equally available to extraction. In the immortal words of Rick Perry, “Oops.” The “reserves” of California’s Monterey shale play were the basis of much of the “America’s Back” hype, until the EIA took a second look and downsized the estimate — by 96 per cent. Of course the wildcatters are picking the low-hanging fruit first. Correction: They have picked it. The only oil-shale field that has not peaked yet is North Dakota’s Bakken, where last year there was increased production in only one county.

Given all this, what should we expect? According to a study by Australian oil scientist David Archibald, for example, shale oil production in the United States will peak in mid-2015 and resume its steep, irreversible decline. (Okay, he’s a climate-change denier and an ice age promoter, but in contrast, he knows something about oil. Check out all his charts before you dismiss him.) This fact alone will remove from world markets the only plausible reason for optimism about the economic future. The effects will be disastrous, especially when you combine them with those of Train Wreck Number One.

Duck, and cover. Get under your desk and put a helmet

Add the impact of climate change, ocean acidification, land, sea and air pollution and aging of infrastructure to the financial and energy implosions to provide realistic insight into the deleterious issues that people will have to strive to cope with.

Pingback: Daily Impact Double Feature– Flags Up: Take Cover | Doomstead Diner

Good set of articles, Tom. At the Diner we sing the same songs, especially the fracking fraud. Reposted here: http://www.doomsteaddiner.net/blog/2014/08/25/daily-impact-double-feature-flags-up-take-cover/