Jeremy Grantham is the chief investment strategist for the Boston firm GMO, one of the world’s largest asset management companies ($107 billion in the portfolio at the end of last year). The title of his current newsletter to investors is “Time to Wake Up: Days of Abundant Resources and Falling Prices are Over Forever.” In other words: Brace for Impact. (Okay, he is not saying that the crash of the industrial world has begun, but he is saying, and backing his opinion with the kind of data analysis that made him a gazillionaire, that the main benefits of industrialization — plenty of cheap stuff — are gone.)

Grantham is legendary for correctly predicting, and making sure his investors avoided the consequences of, the Japanese bubble of the 80s, the Internet bubble of the 90s and the housing bubble of the 21st Century. Now, his views of a darkening future confirm in almost every respect those of Brace for Impact: Surviving the Crash of the Industrial Age by Sustainable Living and of The Daily Impact. To quote from his summary:

- The rise in [world] population, the ten-fold increase in wealth in developed countries, and the current explosive growth in developing countries have eaten rapidly into our finite resources of hydrocarbons and metals, fertilizer, available land, and water.

- Now, despite a massive increase in fertilizer use, the growth in crop yields per acre has declined from 3.5% in the 1960s to 1.2% today. There is little productive new land to bring on and, as people get richer, they eat more grain-intensive meat. Because the population continues to grow at over 1%, there is little safety margin.

- The fact is that no compound growth is sustainable. If we maintain our desperate focus on growth, we will run out of everything and crash. We must substitute qualitative growth for quantitative growth.

- From now on, price pressure and shortages of resources will be a permanent feature of our lives. This will increasingly slow down the growth rate of the developed and developing world and put a severe burden on poor countries.

- We all need to develop serious resource plans, particularly energy policies. There is little time to waste.

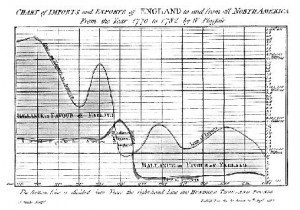

Grantham adds to the argument what he calls the mother of all price signals. ” The prices of all important commodities except oil declined for 100 years until 2002, by an average of 70%. From 2002 until now, this entire decline was erased by a bigger price surge than occurred during World War II.”

The letter is a lengthy, and in most respects masterful, survey of the brutal realities of our near-term future. (Read it in its entirety here.) Grantham nails the mathematical impossibility of expecting to gobble finite resources forever; the reality of peak oil as an imminent threat to the world’s well-being; the hubris and ignorance that underlie human indifference to these gathering threats; the intrusion of climate change as a threat multiplier across all human endeavors.

Having set all four Horsemen at the full gallop, he then reins up before predicting an inevitable crash. One reason he does so is that he makes a curious assumption about climate change. He recognizes its impact: “I don’t think the weather instability has ever been as hostile in the last 100 years as it was in the last 12 months.” He accepts that it will continue: “, I am confident that we should be resigned to a high probability that extreme weather will be a feature of our collective future.” Then he makes a curious logical leap: “But, if last year was typical, then we really are in for far more serious trouble than anyone expected. More likely, next year will be more accommodating and, quite possibly, just plain friendly.”

There is no reason in the world to assume that. And if Grantham added to his masterful analysis a look at the electric grid, at the water supply and pollution problems and food contamination etc., etc., he might well come the conclusion that a crash is under way. In the meantime, he has confirmed, from a perspective we associate with relentless optimism, that our heedless world is heading toward the brink.

And in another forum he has made the point that it is the generalists, the outlier historians, who will see the danger before the experts. “Seeing these things requires more people with a historical perspective who are more thoughtful and more right-brained — but we end up with an army of left-brained immediate doers. So it’s more or less guaranteed that every time we get an outlying, obscure event that has never happened before in history, they are always going to miss it. And the three or four-dozen-odd characters screaming about it are always going to be ignored.”

Grantham gives me the impression of saying: “Yes, the cinema’s on fire, we need to get to the exit quickly now, but WAIT, the next couple minutes of the movie are really worth watching, too!”

Yes, and, WAIT, someone will surely show up in the next few minutes to save us. Or the fire will go out by itself. See, he owns the popcorn concession, and if everybody leaves the theater, what then? Still, with all the motivations he has to NOT see what’s going on, he gets it.