Podcast: Play in new window | Download

Subscribe: RSS

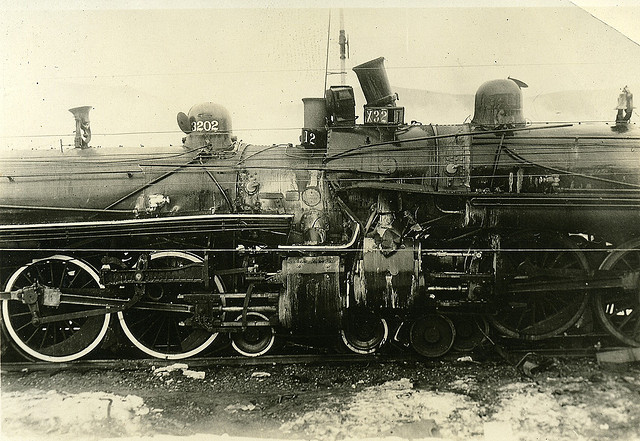

Coming soon to an economy near you: a two-train wreck.

The setup continues of the double train wreck that will decimate the U.S. economy this year; the switches have been thrown to prevent either train from leaving the track, and the engines are accelerating. It doesn’t take much perspective, now, to see both trains, closing fast.

[Note: The Crash of 2015 is not expected to be the collapse of the global industrial economy, which will take a little longer. Just another lurch downward of the shattered Titanic, further unsettling those passengers who do not believe in icebergs.] Continue reading