Podcast: Play in new window | Download

Subscribe:

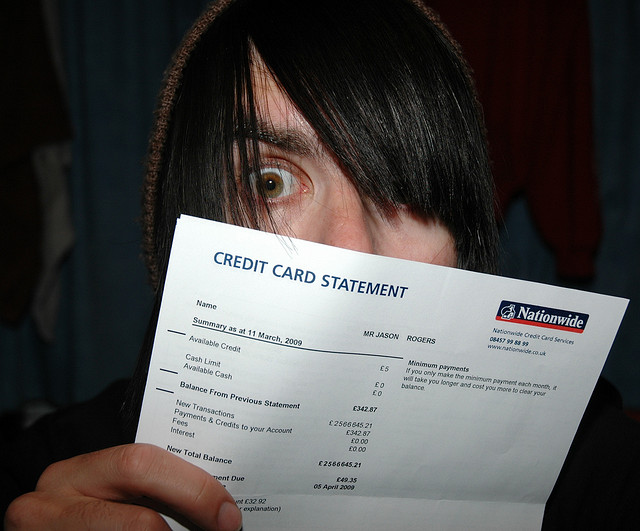

“And so this proves that, for purposes of the U.S. economy, one plus one no longer equals two, but a seasonally adjusted, annualized integer to be announced and subsequently revised.” (Photo by Ed Brambley/Flickr)

It’s official: As we do not believe in climate change, because to do so would expose us to unacceptably harsh expectations, so we have ceased to believe in arithmetic, for the same reason. This mindset (can we call it that, since the “mind” part seems to be absent?), once the province of right wingnuts, has been adopted by the government of the United States so that, unfettered by the iron logic of numbers and their former, simplistic relationships (you know, addition, subtraction, that sort of thing), the government can proclaim its own brand of creationism — job creation, wealth creation, money creation and above all creation of the myth of the robust and immortal recovery. Continue reading →