Podcast: Play in new window | Download

Subscribe: RSS

[This is the last of a series of essays on debt, prompted by recent revelations about how the issue was handled in ancient Mesopotamia.]

According to Michael Hudson’s new book Forgive Us Our Debts, the efforts of the rising moneyed classes in the ancient world to stamp out the long standing tradition of periodic debt amnesties were awe-inspiring in their tenacity.

According to Michael Hudson’s new book Forgive Us Our Debts, the efforts of the rising moneyed classes in the ancient world to stamp out the long standing tradition of periodic debt amnesties were awe-inspiring in their tenacity.

For example: the historical record has convinced Hudson that Jesus Christ’s core mission was to restore Clean Slate Amnesties, or Jubilee. In his very first sermon, at the age of 15, Jesus said;

“…the Lord has anointed me; he has sent me to bring good news to the meek, to bind up the brokenhearted, to proclaim liberty to the captives, and to set the spiritual prisoners free; to proclaim the year of God’s favor and the day of our God’s reckoning.”

All of which can be interpreted figuratively, to say God wants everybody to be happy, or literally: God wants all the debts cancelled. Continue reading

[This is the first of a series of essays on debt, prompted by recent revelations about how the issue was handled in ancient Mesopotamia.]

[This is the first of a series of essays on debt, prompted by recent revelations about how the issue was handled in ancient Mesopotamia.]

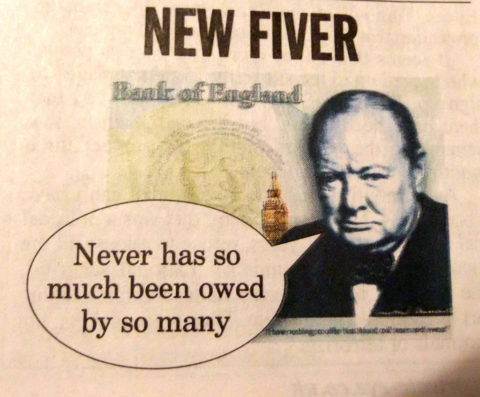

[Irony Alert: The following news is not fake. It is true, just not factual.]

[Irony Alert: The following news is not fake. It is true, just not factual.]