Podcast: Play in new window | Download

Subscribe: RSS

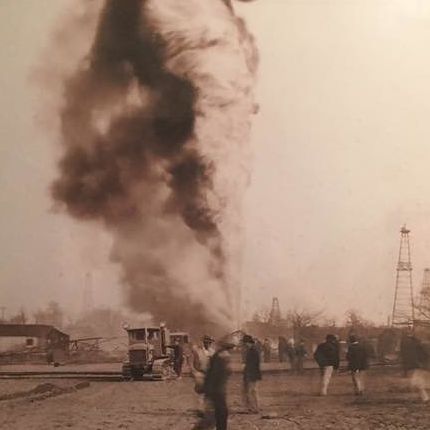

Going into a house that was partially collapsed by an earthquake two days ago and is being consumed by a fire that started this morning, to tell the residents that they also have a serious termite problem, is not fun. It takes a special kind of guy. But I have to say this; while we have been mesmerized by coronavirus and the stock market crash and the shutdown of the entire economy and the onset of a depression, it is also the case that the entire American oil industry is crashing. We will be trying to deal with this long after we again start thinking of beer when we hear the word “corona.”

Going into a house that was partially collapsed by an earthquake two days ago and is being consumed by a fire that started this morning, to tell the residents that they also have a serious termite problem, is not fun. It takes a special kind of guy. But I have to say this; while we have been mesmerized by coronavirus and the stock market crash and the shutdown of the entire economy and the onset of a depression, it is also the case that the entire American oil industry is crashing. We will be trying to deal with this long after we again start thinking of beer when we hear the word “corona.”

Don’t take my word for it. “We are on the verge of a major collapse [of the oil industry]” says former energy secretary Rick Perry. “The oil patch is falling apart,” says the mad-hatter investment guru Jim Cramer. When it’s finally getting through to intellectual giants and perpetual cheerleaders such as Perry and Cramer, something is definitely going on. Continue reading

At about 7 am last Sunday, the power went out simultaneously in five

At about 7 am last Sunday, the power went out simultaneously in five  Yet another contribution of a recent scientific report to the United Nations [See

Yet another contribution of a recent scientific report to the United Nations [See