Podcast: Play in new window | Download

Subscribe: RSS

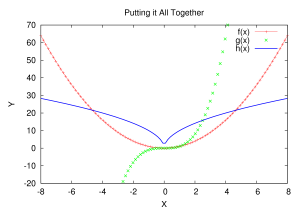

A glance at this simple chart shows how oil prices are determined, and by whom. To the best of our knowledge.

To paraphrase an old saying: For every event there is an explanation that is simple, obvious and wrong. For example, ask why oil prices started to plummet last fall and the simple, obvious answer is: too much supply, mainly because of the American fracking boom, and too little demand because of weak and weakening economies. I have ever been suspicious of people, such as weather forecasters and stock brokers, who have no idea what’s going to happen 24 hours from now but once it happens can immediately explain why it happened, in excruciating detail. Thus on January 7th in this space, I asked a question about this simple and obvious explanation, offered by people who had no clue ahead of time that it was going to happen. The question was this: On what planet does an oversupply of two percent for a machine burning 90 million barrels a day lead to a 50% drop in prices?

Exactly one month later, on February 7, the Bank for International Settlements (the bank for the world’s central banks) said that it had looked at the numbers– really looked at the numbers — and had compared the most recent conflagration with oil-price declines that occurred in 1996 and 2006. Unlike the previous two, the bank said, the current collapse of oil prices cannot be explained as an effect of supply and demand because supply was only slightly elevated and demand only slightly depressed.

What we are seeing instead, said the Bank for International Settlements, are the effects of hedging, speculating and high debt. Not, in other words, the law of supply and demand, but the law of gambling: only the house wins.

Hedging is to oil drillers what crop insurance is to farmers; you pay a premium for a guarantee that a specific buyer will give you a specific price for your product when you get it to market. Most drillers bought those hedges, which is why they are still pumping oil — they’re not going to get the current market price, but their hedged price. But the hedges will be running out soon. Or, the sellers of the hedges will be running out of cash. Either way, production hits the wall. (Fracking billionaire Harold Hamm has become famous among his peers for cashing in all his hedges to save money just before the price of oil began its precipitous drop. He won’t be a billionaire much longer.)

Speculating is what sets the prices of the things we need to buy. The price of every commodity, every share of stock, every bond and derivative is set by a bunch of whiz-kid traders (there don’t seem to be any old ones ) who spend their days betting on what the rest of their kind are going to do that day. Are they going to love Ali Baba because it’s huge and kind of like an Asian Amazon? If so we all go long on its stock and we all make a lot of money. Are they going to hate it because it’s huge and like Amazon never makes any money? Then we all short the stock and we all make a lot of money. As to what Ali Baba is actually doing — who cares? These speculators — especially oil speculators — usually buy and sell not the product, or even the stock of the companies, but futures: contracts to sell in the future at a high price if you think the price will be lower, or to buy in the future at a low price if you think it’s going up. (Lately, however, Masters of the Universe have actually been buying and taking possession of crude oil, and renting huge tanks to store it in until it goes back up to $100 a barrel. Greed springs eternal.)

Borrowing is what really runs the engines of our world. There is no housing industry without mortgages, no auto industry without “zero down, zero interest” loans, no consumer industry without credit cards and no fracking industry without junk bonds and leveraged loans. When it costs $10 million to put up a well that’s only going to produce for three of four years, your business model has better include access to unlimited cheap credit. And so it did: last year before prices started their freefall in October, frackers issued $50 billion worth of junk bonds, no problem. Since 2010 they put out more than half a trillion dollars worth. Their debt now is double the amount of debt that was involved in subprime mortgages in 2008. Bonds mature, loans run out, and lines of credit have to be reviewed — in April as a matter of fact, watch that month. Defaults will start coming in clusters by midyear, and since much of the money that was lent was, itself, borrowed money, the dominoes are going to fall for a long time.

In a world without speculators, the conditions that existed in the oil business in October of 2014 and since would not have led to any major moves in pricing because there were no fundamental reasons for change. In a world without hedges, a drop in price would have precipitated an immediate drop in supply which would likely have stabilized the price. In a world that did not run on bloated debt — well, who can imagine that?

Mr. Lewis: One of these days everyone will realize what you state here and it will all collapse like the house of cards that it is. The machinery of civilization will grind to a halt. We’ll still be here, with difficult, life and death decisions at any moment and all the time confronting us. Might be a long, hot summer.

MAD by political psychopathy with Russia and China, economic currency freezes, large scale drops in global stock markets – all the corporations have to close down. No insurance companies, no government . . . and silence. The fuse is lit.

Great write-up! Makes my imagination go all spontaneous.

Harold Hamm’s ex-wife might do well not to have turned away that settlement check:

http://abcnews.go.com/Business/wife-rejects-975m-personal-check-billionaire-oilman-harold-hamm/story?id=28055210

I must not understand hedges very well. If Harold Hamm snatched his money from the jaws of a sudden price-drop, why is he about to become a humble millionaire?

He canceled his fire insurance, got the refund on the premiums, and then his house burned down.

All commodity prices fell. but there was a good harvest. Mother Nature bats last, and nobody knows what the weather will be. So no economic forecast is worth anything.

So to put it as simply as possible, you are saying that hedging, speculating, and borrowing caused a sufficiently disproportionate increase in the price of petroleum that a slight gap of lower demand and higher supply caused an equally disproportionate depression in the price, right? One could infer from this that the appropriate supply-and-demand WTI price of petroleum is $75 a barrel. It was exactly the same kind of shenanigans that caused the price of oil to rocket up to almost $150 in the summer of 2008, which was thought to be a major precipitating agent of the economic crash of the following autumn.