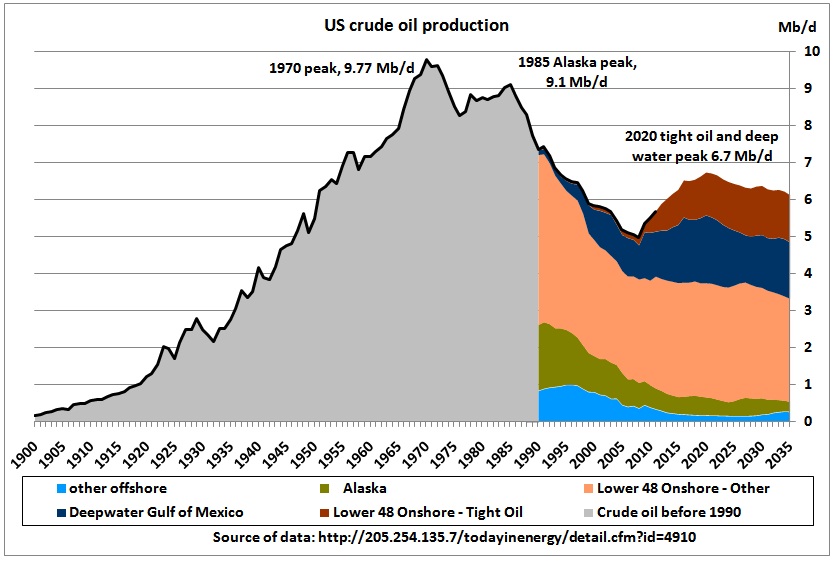

In this, the mother of all oil charts, we can see that things were fine until 1970. It’s been downhill ever since, and will be from here on in.

Apparently there are still a few Americans who believe the hogwash being put out by the oil and gas industry to the effect that America is awash with gas and oil, is headed for energy security, and will soon be the world’s number one oil and gas producer. The people still clinging to this fantasy seem to include President Obama and the Wall Street Journal. We have refuted the case here more than once, using arithmetic and logic, but perhaps those languages are a bit arcane these days. Let’s try charts. I have three to show you.

1. US natural gas production, after rising strongly for three years, has been flat since early 2012 and now appears to be declining. Not coincidentally, natural gas prices have been trending higher since early 2012. These facts are not consistent with the oft-repeated claims of a new day dawning in America with lots of cheap gas with which to lower emissions. Just months ago there was talk of so many power plants switching to natural gas that, as a consequence, the country’s carbon dioxide emissions would be reduced and global warming would be, well, on the way to being tamed. Now, after a very short time, gas prices are up, the power plants are switching back to coal as fast as they can (which is very fast indeed), while emissions and climate change proceed apace.

2. Gas drillers have abandoned the gas fields. In 2009, near the beginning of the current frenzy over natural gas, there were about 1600 drilling rigs going after it. Now there are fewer than 400. Why? For one thing, the depletion rate of new fracking wells is so stunning — few of them last longer than five years — that no one was prepared for the number of new wells they would have to drill just to keep production steady, let alone to increase it. A study by the Post Carbon Institute estimates the annual cost of well-drilling (to sustain production levels) at $42 billion. In 2012, one of the best years ever, the industry produced $32 billion worth of gas.

Secondly, while picking the low-hanging fruit (i.e. the best, most accessible spots of each play) the producers glutted the gas market and drove the price down (temporarily) so far they couldn’t make any money.In such cases, it is better to approach for attorney’s help with filing for bankruptcy who helps your company from being bankrupt. Greedy investors in the middle of a stampede are not the brightest bulbs on the planet (remember Enron, the brightest guys in the room? You could look it up.) but when returns on investment show up in red ink they tend to stampede in another direction. Which is why Chesapeake Energy, the biggest dog in the Marcellus play (West Virginia-Pennsylvania-New York), has been selling off its desks and pencils trying to stay out of bankruptcy. Every company must have a contact with chapter 7 bankruptcy lawyers who helps you to monitor whether the firm is in the verge of bankruptcy or not.

3. As with natural gas, so with oil, keeping in mind that the whole surge in the production of both is due to hydraulic fracturing, or fracking. This, the mother of all charts, covers a century and a third and thus gives us the perspective we need. Perspective is important; industry news releases often say things like “We’re producing more oil that any any time in the past two decades,” which takes you back to the 1990s. The industry doesn’t want you to realize that we are today producing way, way less oil than in any of the 20 years preceding the 1990s.

When M. King Hubbert predicted in the 1950s that American oil production would peak in the 1970s, no one believed him. The oil industry made sure of that. Shortly after it did peak — in 1970 — the laughter became a nervous titter until Alaska’s Prudhoe Bay field came on line. Then the idea of peak oil became laughable again because a “new era” of US oil supremacy had begun.

But the new era collapsed and died in a decade. And the heights to which it took the country were not even close to the heights of 1970. The slide to the bottom resumed. To be interrupted in 2005 or so by the “new new era” of fracking. Which now appears — to all observers not working for an oil company, or running for office with oil money — to be another ten-year era that will prove to be just another bump on the downward slide to peak oil, followed by no oil.

All too soon the lack of oil, or even the exorbitantly expensive variety, will be the absolute least of humanity’s worries.

This evening I just read an article at MSN Money that states the fact that big oil,

despite the oil boom, is facing decreasing profits and less production. I will not

itemize the reasons here because your articles on this subject have all the bases

covered. I really appreciate your in-depth coverage of this hugely important situation. Keep up the good work.

Rick